As a tax and accounting expert, your clients expect a professional invoice to match such a professional service, after all, your income and reputation are at stake. Today, we are taking the first step towards delivering a stronger invoicing process on TaxDome.

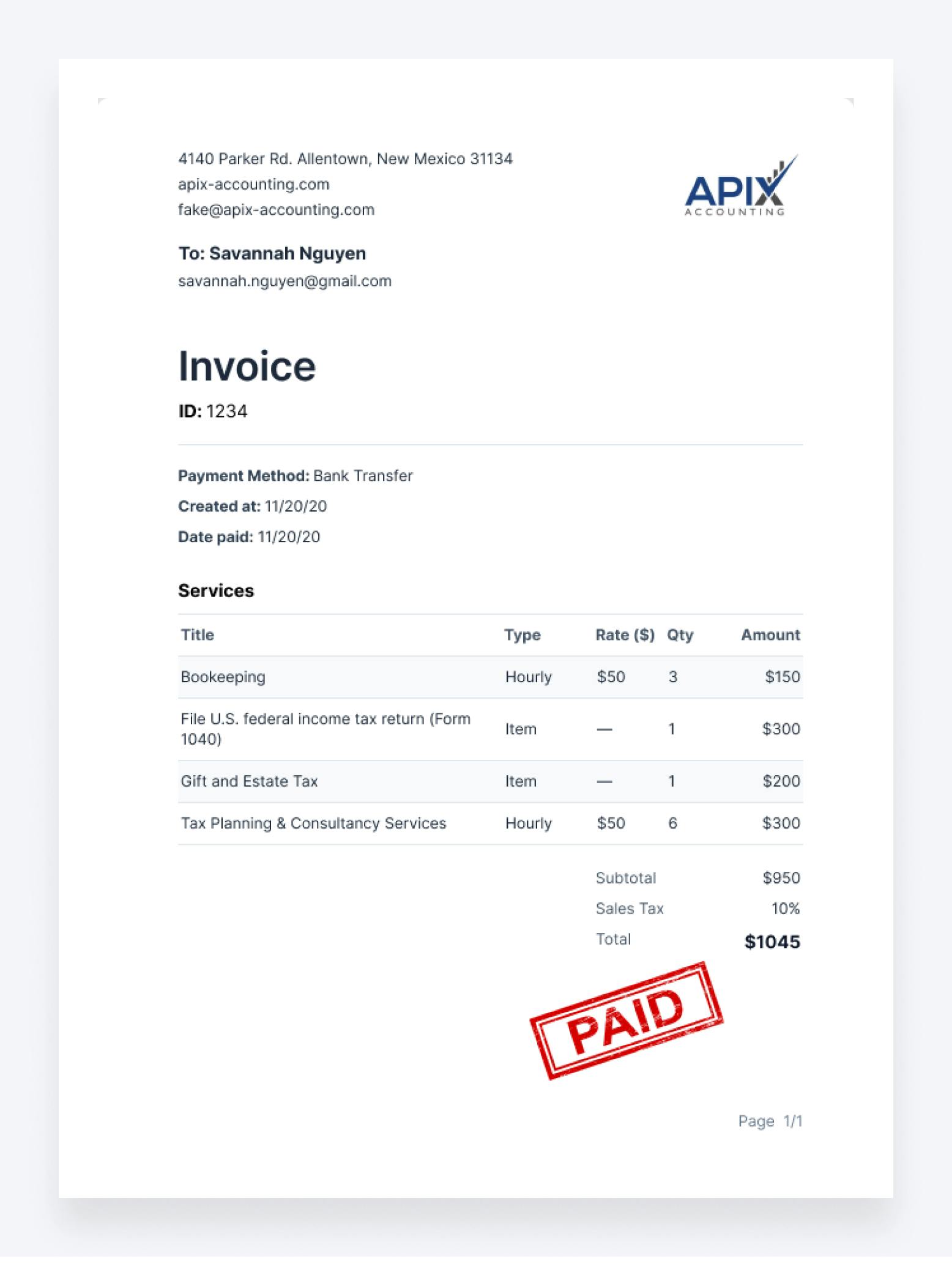

We are excited to introduce professional-looking PDF invoices, designed in line with the industry standard and automatically branded with your company logo.

You no longer have to use external software to generate invoices and perform extra steps in the process of billing your clients. Within a single TaxDome ecosystem, you can now create detailed invoices with a pricing breakdown, print them, and share them with your clients via email or portal.

Your clients can download their fully structured invoices via the web- and mobile-friendly client portal or as an email attachment, and pay you online or offline.

What’s next?

We are planning to implement a function for setting discounts on invoices. You will also be able to create and edit a taxable line item in the invoice and save it to the service library for future use.

Learn more about TaxDome’s printable PDF invoices by visiting our Help Center.

If you have any suggestions on the invoicing process, just let us know on the Feature Request Board!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. please try again later

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers